Hours x pay calculator

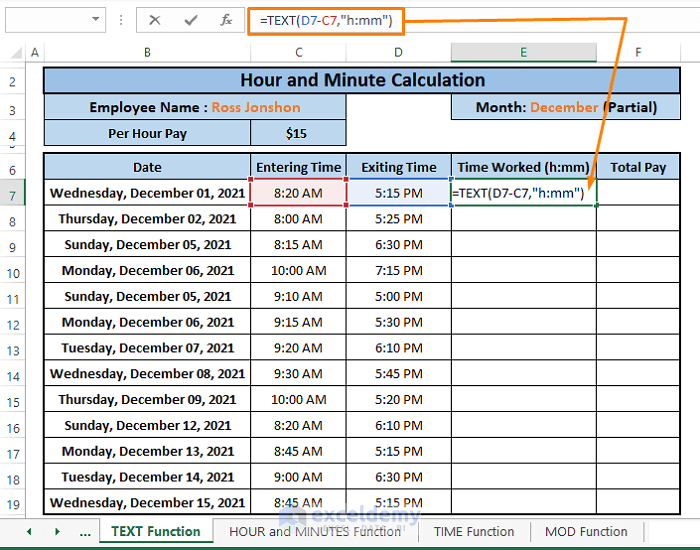

Due to the nature of hourly wages the amount paid is variable. Find out the benefit of that overtime.

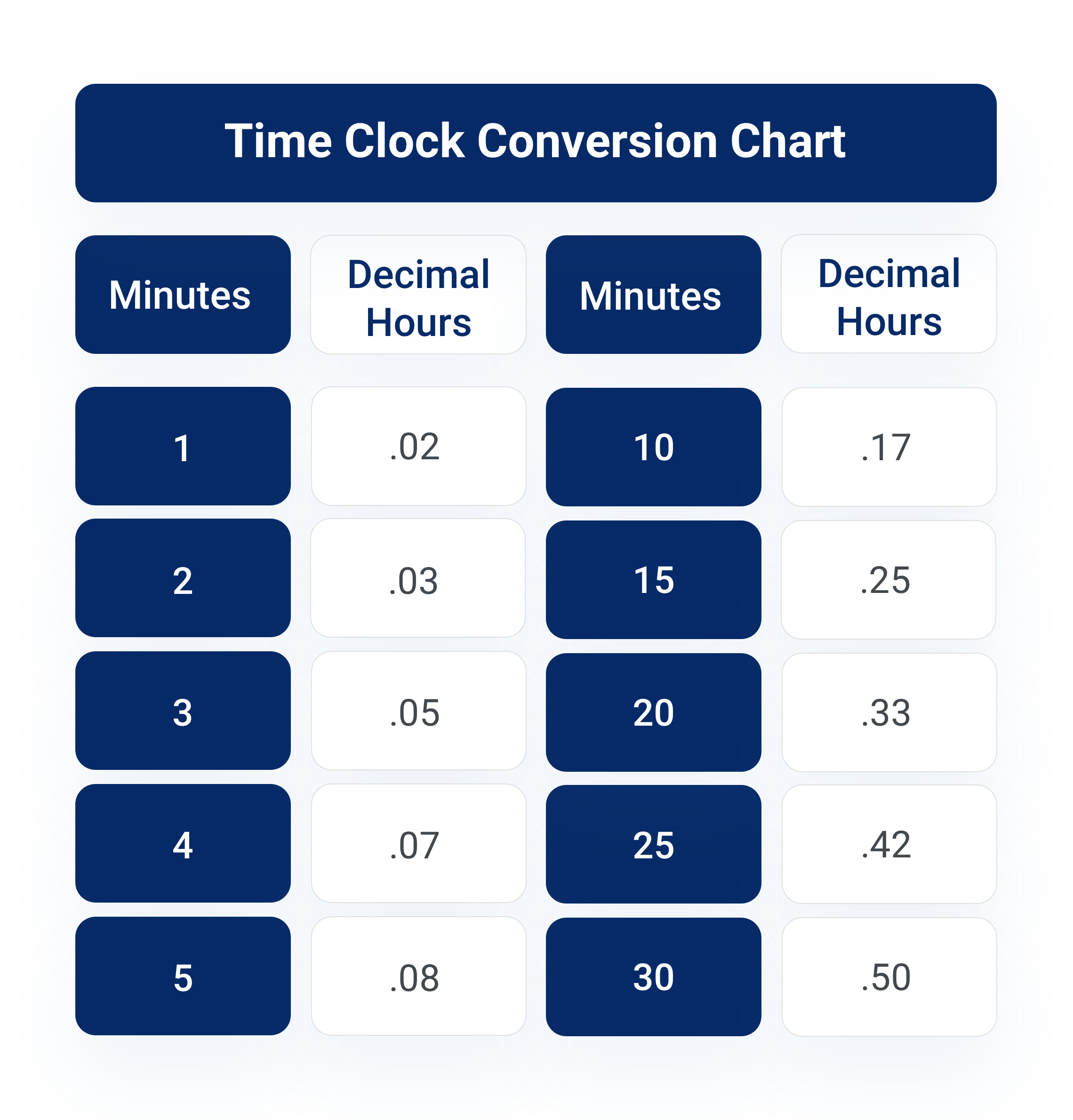

Time Clock Conversion Calculator For Payroll Hourly Inc

Based on this the average salaried person works 2080 40 x 52 hours a year.

. - regular hours worked in a month 160 - standard hourly pay rate 20 - overtime hours worked. The average full-time salaried employee works 40 hours a week. It comprises the following components.

Next take the total hours worked in a year. 37 x 50 1850 hours. For example if an employee makes 25 per hour.

1Use Up Arrow or Down Arrow to choose between AM and PM. Divide this resulting figure by the number of paid weeks you work each year to get your hourly rate. Then multiply that number by the total number of weeks in a year 52.

You can also determine the annual salary of an employee by multiplying their hourly wage by the number of hours they work in a year. Print our hourly wage calculator A. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

Some people define a month as 4 weeks. 1500 per hour x 40 600 x 52 31200 a year. 2Enter the Hourly rate without the dollar sign.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. This is equal to 37 hours times 50 weeks per year there are 52 weeks in a year but she takes 2 weeks off. Hourly Monthly salary 12 Hours per week Weeks per year.

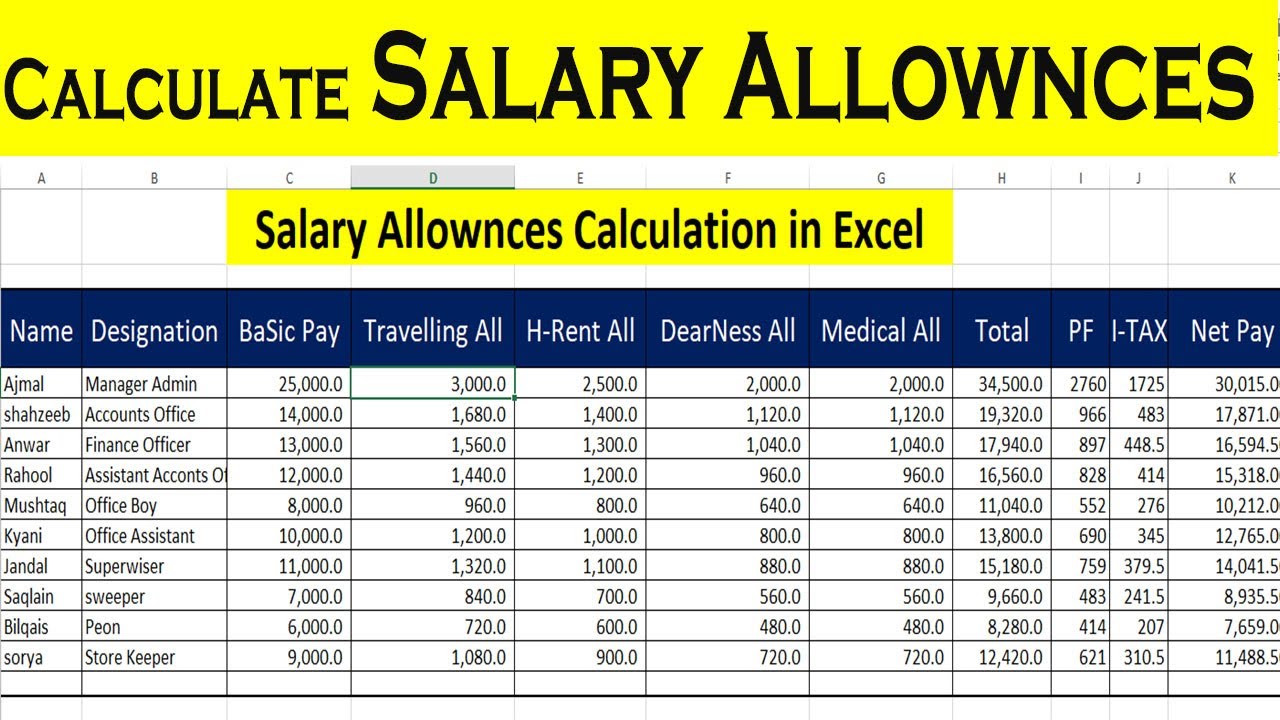

See where that hard-earned money goes - Federal Income Tax Social Security. Lets make the following assumptions and determine the total gross pay. Multiply the hourly wage by the number of hours worked per week.

For monthly salary this calculator takes the yearly salary and divides it by 12 months. Assuming you make a hundred thousand dollars in 12 months your hourly wage is 100000 2080 or 4807. For the cashier in our example at the.

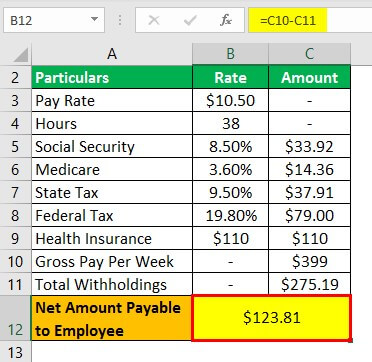

Components of Payroll Tax. Based on a standard work week of 40 hours a full-time. To decide your hourly salary divide your annual income with 2080.

Enter the number of hours and the rate at which you will get paid. Hourly salary X. Case for tab 1.

This component of the Payroll tax is withheld and forms a revenue source for the Federal. To determine your hourly wage divide. For example for 5 hours a month at time and a half enter 5 15.

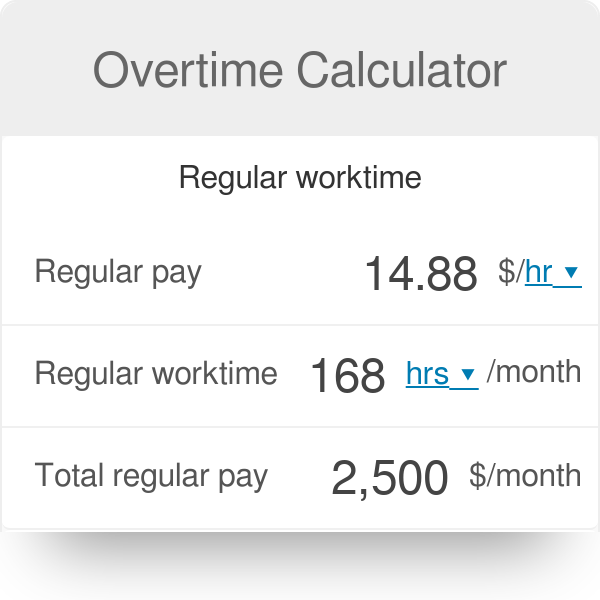

Overtime Calculator

Payroll Formula Step By Step Calculation With Examples

Biweekly Time Sheet Invoice Template Word Timesheet Template Card Templates Free

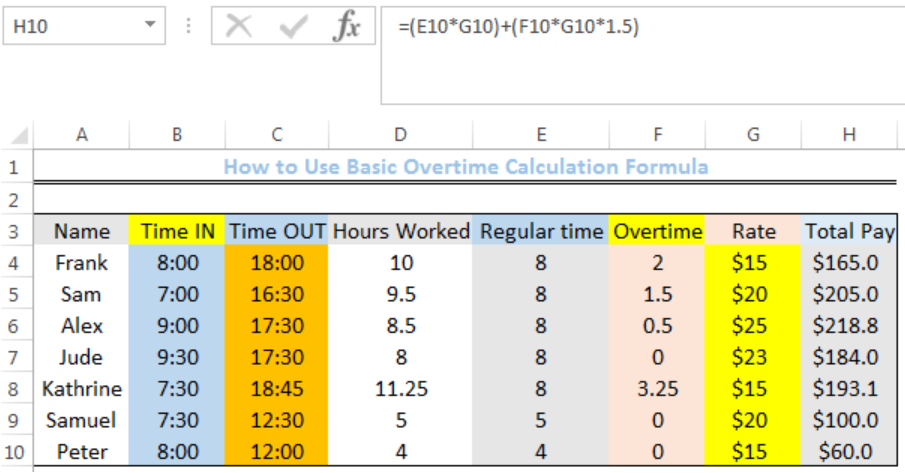

Excel Formula Basic Overtime Calculation Formula

Excel Formula To Calculate Hours Worked And Overtime With Template Excel Formula Excel Life Skills

Paycheck Calculator Oklahoma Hourly 2022 In 2022 Paycheck Ways To Save Money Save Money Fast

Payroll Calculator Template Free Payroll Template Payroll Templates

How To Calculate Hours And Minutes For Payroll Excel 7 Easy Ways

Calculate Salary Allowances And Tax Deduction In Excel By Learning Cente Excel Learning Centers Tax Deductions

Overtime Calculator To Calculate Time And A Half Rate And More

Bi Weekly Budget Spreadsheet Paycheck To Paycheck Budget Etsy Budget Spreadsheet Budgeting Monthly Budget Template

Pay Stub Calculator Templates 13 Free Docs Xlsx Pdf Payroll Template Templates Paying

Casio Fx 300 Scientific Calculator Pink Scientific Calculator Scientific Calculators Math Graphic Organizers

Hourly To Salary Calculator

Python Program To Calculate Gross Pay Python Programming Python Helpful

How To Calculate Travel Nursing Net Pay Bluepipes Blog Travel Nursing Travel Nursing Pay Nurse

Teaching Resources Lesson Plans Teachers Pay Teachers